This is Part Three of a series on how incentives affect the distribution of energy/resources throughout a society and the destructive effects of social systems like communism. (Part One and Part Two are here)

But before we criticize these programs too much, let’s understand where they came from:

The Industrial Revolution, which began around 1760 in Britain, created mass economic and social dislocation as millions of workers were forced off their farms and flooded into the cities.

The booms and busts of the unregulated (and regulated) industrial economy caused sudden, unpredictable unemployment and, without a social safety net of some kind, starvation. This suffering unleashed Marxism, which soon transformed into an anti-capitalist, anti-Western ideology and tore across the planet, demolishing regimes and killing millions of people.

Reason.com attributes 94 million deaths to communism. The Black Book of Communism places the total between 85 and 100 million people. Historian on the Warpath totals almost 150 million people killed or murdered by communist governments, not including war deaths. (Wikipedia estimates that WWII killed, between battle deaths in Europe and the Pacific, disease, starvation, and genocide, 50-80 million people–and there were communists involved in WWII, also.)

The US and Europe, while not explicitly communist, have adopted many of socialism’s suggestions: Social Security, Welfare, Medicaid, etc., many in direct response to the Great Depression.

The US and Europe, while not explicitly communist, have adopted many of socialism’s suggestions: Social Security, Welfare, Medicaid, etc., many in direct response to the Great Depression.

These solutions are, at best, a stop-gap measures to deal with the massive changes new technologies are still causing. Remember, humans were hunter-gatherers for 190,000 years. We had a long time to get used to being hunter gatherers. 10,000 years ago, a few of us started farming, and developed whole new cultures. A mere 200 years ago, the Industrial Revolution began spreading through Europe. Today, the “post industrial information economy” (or “robot economy,” as I call it,) is upon us, and we have barely even begun to adapt.

We are in an age that is–out of our 200,000 years of existence–entirely novel and the speed of change is increasing. We have not yet figured out how to cope, how to structure society for the long-term so that we don’t accidentally break it.

We have gotten very good, however, at creative accounting to make it look like we are producing more than we are.

By the mid-1950s, the Industrial Revolution had brought levels of prosperity never before seen in human history to the US (and soon to Europe, Japan, Korea, etc.) But since the ’70s, things seem to have gone off-track.

By the mid-1950s, the Industrial Revolution had brought levels of prosperity never before seen in human history to the US (and soon to Europe, Japan, Korea, etc.) But since the ’70s, things seem to have gone off-track.

People fault outsourcing and trade for the death of the great American job market, but technical progress and automation also deserve much of the blame. As the Daily Caller reports:

McDonald’s has announced plans to roll out automated kiosks and mobile pay options at all of its U.S. locations, raising questions about the future of its 1.5 million employees in the country and around the globe.

Roughly 500 restaurants in Florida, New York and California now have the automated ordering stations, and restaurants in Chicago, Boston, San Francisco, Seattle and Washington, D.C., will be outfitted in 2017, according to CNNMoney.

The locations that are seeing the first automated kiosks closely correlate with the fight for a $15 minimum wage. Gov. Andrew Cuomo signed into law a new $15 minimum wage for New York state in 2016, and the University of California has proposed to pay its low-wage employees $15.

There is an obvious trade-off between robots and employees: where wages are low enough, there is little incentive to invest capital in developing and purchasing robots. Where wages are high, there is more incentive to build robots.

The Robot Economy will continue to replace low-skilled, low-wage jobs blue collar workers and young people used to do. No longer will teenagers get summer jobs at McDonald’s. Many if not most of these workers are simply extraneous in the modern economy and cannot be “retrained” to do more information-dependent work. The expansion of the Welfare State, education (also paid for with tax dollars,) and make-work administrative positions can keep these displaced workers fed and maybe even “employed” for the foreseeable future, but they are not a long-term solution, and it is obvious that people in such degraded positions, unable to work, often lose the will to keep going.

The Robot Economy will continue to replace low-skilled, low-wage jobs blue collar workers and young people used to do. No longer will teenagers get summer jobs at McDonald’s. Many if not most of these workers are simply extraneous in the modern economy and cannot be “retrained” to do more information-dependent work. The expansion of the Welfare State, education (also paid for with tax dollars,) and make-work administrative positions can keep these displaced workers fed and maybe even “employed” for the foreseeable future, but they are not a long-term solution, and it is obvious that people in such degraded positions, unable to work, often lose the will to keep going.

But people do not appreciate the recommendation that they should just fuck off and die already. That’s how you get communist revolutions in the first place.

But people do not appreciate the recommendation that they should just fuck off and die already. That’s how you get communist revolutions in the first place.

Mass immigration of unskilled labor into a market already shrinking due to automation / technological progress is a terrible idea. This is Basic Econ 101: Supply and Demand. If the supply of labor keeps increasing while the demand for labor keeps decreasing, the cost of labor (wages) will plummet. Likewise, corporations quite explicitly state that they want immigrants–including illegal ones–because they can pay them less.

In an economy with more demand than supply for labor, labor can organize (unions) and advocate in behalf of its common interests, demanding a higher share of profits, health insurance, pensions, cigarette breaks, etc. When the supply of labor outstrips demand, labor cannot advocate on its own behalf, because any uppity worker can simply be replaced by some desperate, unemployed person willing to work for less and not make a fuss.

Note two professions in the US that are essentially protected by union-like organizations: doctors and lawyers. Both professions require years of expensive training at exclusive schools and high scores on difficult tests. Lawyers must also be members of their local Bar Associations, and doctors must endure residency. These requirements keep out the majority of people who would like to join these professions, and ensure high salaries for most who do.

Note two professions in the US that are essentially protected by union-like organizations: doctors and lawyers. Both professions require years of expensive training at exclusive schools and high scores on difficult tests. Lawyers must also be members of their local Bar Associations, and doctors must endure residency. These requirements keep out the majority of people who would like to join these professions, and ensure high salaries for most who do.

While Residency sounds abjectly awful, the situation for doctors in Britain and Ireland sounds much worse. Slate Star Codex goes into great detail about the problems:

Many of the junior doctors I worked with in Ireland were working a hundred hours a week. It’s hard to describe what working 100 hours a week is like. Saying “it means you work from 7 AM to 9 PM every day including weekends” doesn’t really cut it. Imagine the hobbies you enjoy and the people you love. Now imagine you can’t spend time on any of them, because you are being yelled at as people die all around you for fourteen hours a day, and when you get home you have just enough time to eat dinner, brush your teeth, possibly pay a bill or two, and curl up in a ball before you have to go do it all again, and your next day off is in two weeks.

And this is the best case scenario, where everything is spaced out nice and even. The junior doctors I knew frequently worked thirty-six hour shifts at a time (the European Court of Human Rights has since declined to fine Ireland for this illegal practice). …

The psychological consequences are predictable: after one year, 55% of junior doctors describe themselves as burned out, 30% meet criteria for moderate depression, and 12% report considering suicide.

A lot of American junior doctors are able to bear this by reminding themselves that it’s only temporary. The worst part, internship, is only one year; junior doctorness as a whole only lasts three or four. After that you become a full doctor and a free agent – probably still pretty stressed, but at least making a lot of money and enjoying a modicum of control over your life.

In Britain, this consolation is denied most junior doctors. Everyone works for the government, and the government has a strict hierarchy of ranks, only the top of which – “consultant” – has anything like the freedom and salary that most American doctors enjoy. It can take ten to twenty years for junior doctors in Britain to become consultants, and some never do.

I don’t know about you, but I really don’t want my doctor to be suicidal.

Now, you may notice that Scott doesn’t live in Ireland anymore, and similarly, many British doctors to take their credentials and move abroad as quickly as possible. The British medical system would be forced to reform if not for the influx of foreign doctors willing to put up with hell in exchange for not living in the third world.

From the outside, many of these systems, from underfunded pensions to British medicine, look just fine. Indeed, an underfunded pension will operate just fine until the day it runs out of money. Until that day, everyone who clams the pension is in deep trouble looks like Chicken Little, running around claiming that the sky is falling.

There’s a saying in finance: The market can stay irrational longer than you can stay solvent.

BTW, the entire state of California is in deep trouble, from budget problems to insane property tax laws. They already consume far more water than they receive, (and are set for massive forest fires,) but vote for increased population via immigration with Mexico. California’s economy is being propped up by–among other things–masses of cash flowing into Silicon Valley. This is Dot.Com Bubble 2.0, and like the first, it will pop–the only question is when. As Reuters reported last February:

LinkedIn Corp’s (LNKD.N) shares closed down 43.6 percent on Friday, wiping out nearly $11 billion of market value, after the social network for professionals shocked Wall Street with a revenue forecast that fell far short of expectations. …

As of Thursday, LinkedIn shares were trading at 50 times forward 12-month earnings, making it one of the most expensive stocks in the tech sector.

Twitter Inc (TWTR.N) trades at 29.5 times forward earnings, Facebook Inc (FB.O) at 33.8 times and Alphabet Inc (GOOGL.O) at 20.9 times.

Even after the selloff, LinkedIn’s shares may still be overvalued, according to Thomson Reuters StarMine data.

LinkedIn should be trading at $71.79, a 30 percent discount to the stock’s Friday’s low, according to StarMine’s Intrinsic Valuation model, which takes analysts’ five-year estimates and models the growth trajectory over a longer period.

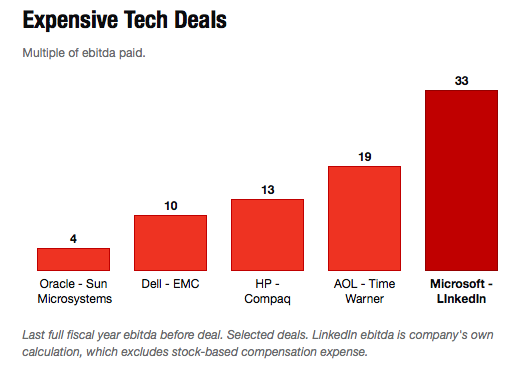

Linked in has since been bought out by Microsoft for $26 billion. As Fortune notes, this is absolutely insane, as there is no way Microsoft can make back that much money off of LinkedIn:

“Ebitda” stands for Earnings Before Interest, Tax, Depreciation and Amortisation. There is absolutely no way that LinkedIn, a social network that barely turns a profit, is worth more than Sun, EMC, Compaq, and Time Warner.

Shares normally trade around 20x a company’s previous year’s earnings, though right now the S & P’s P/E ratio is around 25. In 2016, LinkedIn’s P/E ratio has been around 180. (Even crazier, their ratio in 2015 was -1,220, because they lost money.)

Ever wonder where all of that money from QE is going? It’s turning into Ferraris cruising around San Francisco, and LinkedIn is not the only offender.

But these companies will not maintain fantasy valuations forever.

(While we’re at it: Why the AOL-Time Warner Merger Went so Wrong:

When the deal was announced on Jan. 10, 2000, Stephen M. Case, a co-founder of AOL, said, “This is a historic moment in which new media has truly come of age.” His counterpart at Time Warner, the philosopher chief executive Gerald M. Levin, who was fond of quoting the Bible and Camus, said the Internet had begun to “create unprecedented and instantaneous access to every form of media and to unleash immense possibilities for economic growth, human understanding and creative expression.”

The trail of despair in subsequent years included countless job losses, the decimation of retirement accounts, investigations by the Securities and Exchange Commission and the Justice Department, and countless executive upheavals. Today, the combined values of the companies, which have been separated, is about one-seventh of their worth on the day of the merger.)

So, that was a bit of a long diversion into the sheer artificiality of much of our economy, and how sooner or later, the Piper must be paid.

When I try to talk to liberal friends about the problems of increasing automation and immigration on the incomes of the American working class, their response is that “We just need more regulation.”

When I try to talk to liberal friends about the problems of increasing automation and immigration on the incomes of the American working class, their response is that “We just need more regulation.”

In this cheerful fantasy, we can help my friend who cannot afford health insurance by requiring his employer to provide health insurance–when in reality, my friend now cannot find a job that lasts for more than a month because employers just fire him before the health insurance requirement kicks in. In fantasy land, you can protect poor people by making it harder for landlords to evict them, but in the real world, this makes it even harder for the poorest to get long-term housing because no landlord wants to take the chance of getting stuck with them. In fantasy land, immigration doesn’t hurt wages because you can just legislate a higher minimum wage, but the idea that you can legislate a wage that the market does not support is an absurdity worthy only of the USSR. In the real world, your job gets replaced with a robot.

This is not to say that we can’t have some form of welfare or social safety net to deal with the dislocations and difficulties of our new economy. Indeed, some form of social welfare may, in the long run, make the economic system more robust by allowing people to change jobs or weather temporary unemployment without dying. Nor does it mean that any inefficiency is going to break the system. But long-term, using legislation to create a problem and then using more legislation to prevent the market from correcting it increases inefficiency, and you are now spending resources to enforce both laws.

This is not to say that we can’t have some form of welfare or social safety net to deal with the dislocations and difficulties of our new economy. Indeed, some form of social welfare may, in the long run, make the economic system more robust by allowing people to change jobs or weather temporary unemployment without dying. Nor does it mean that any inefficiency is going to break the system. But long-term, using legislation to create a problem and then using more legislation to prevent the market from correcting it increases inefficiency, and you are now spending resources to enforce both laws.

Just like Enron’s “creative accounting,” you cannot keep hiding losses indefinitely.

You can have open-borders capitalism with minimal welfare, in which the most skilled thrive and survive and the least skilled die out. This is more-or-less the system in Singapore (see here for a discussion of how they use personal savings accounts instead of most welfare; a discussion of poverty in Singapore; and Singapore’s migration policies.)

Or you can have a Japanese or Swedish-style welfare state, but no open borders, (because the system will collapse if you let in just anyone who wants free money [hint: everyone.])

But you cannot just smash two different systems together, heap more laws on top of them to try to prevent the market from responding, and expect it to carry on indefinitely producing the same levels of wealth and well-being as it always has.

The laws of thermodynamics are against you.

“if not for the influx of foreign doctors willing to put up with hell in exchange for not living in the third world.”

Do those foreign doctors actually put up with the conditions that British doctors do? Or do they actually just inflict hell- or laziness and stupidity- on their British victims?

LikeLike

I don’t know, but maybe someone knowledgeable about the British medical system can weigh in.

LikeLike

>The booms and busts of the unregulated (and regulated) industrial economy caused sudden, unpredictable unemployment and, without a social safety net of some kind, starvation.

I am not sure I agree with this model. More likely that starvation events fell in frequency as the economy became more global and diverse. For instance, potatoes made it possible for peasants to survive rampaging armies’ expropriation (because it’s one thing to loot a granary and another to go dig all the potatoes out of a field.)

>This suffering unleashed Marxism, which soon transformed into an anti-capitalist, anti-Western ideology and tore across the planet, demolishing regimes and killing millions of people.

I don’t think so. Marxism took off towards the end of the Victorian era, when starvation, misery and unemployment were at historic lows.

Further, Marxism/socialism were not spontaneous phenomena. Rather, they were purposely developed, sponsored, propagated and lobbied for by small, elite groups, funded by the super-rich (Carnegie, JP Morgan, etc.) working over decades.

Sutton talks about how socialism allows the transformation of target societies into captive markets. Russia and China were not a threat to the Western elites as long as they were socialist. It also allows the one-way transformation of wealth into power. In the absence of socialism, wealth can come and go. Today’s industrial titan can have his wealth destroyed through crashes, innovation, etc. However, by using his wealth to coopt a government, he can create regulations which will stifle competitors (eg Sarbanes-Oxley,) have the government bail him out during crashes (recent examples abound,) ideally even create fiat currency (effectively sucking up wealth from the rest of the economy.)

Of course you can’t just go from a free market to oligarchic socialism. It takes a lot of (mandatory) education to brainwash the population to be complacent. It also takes a lot of hot and cold wars, as well as economic crashes to justify more emergency powers which don’t go away after the emergency, and various regulatory and enforcement entities which never go away. It also takes the progressive destruction of communities, families, guilds and other entities which stand between the individual and the oligarchically-owned, totalitarian state. But once you’re done with this process, you are safe from competition from below. If you’ve successfully exported your system worldwide, you are safe from competition from the sides as well. The only threats come from within your own class.

LikeLike

Short of war, I agree that there were no famine-level events (that I know of) post industrialization in core Europe. (Potential caveat Ireland.) “Starvation” was probably overly strong for “periodic bouts of hunger occasioned by getting fired,” with modern industrial economic vagaries making the cycles of employment and unemployment less predictable/expected than the old cycles of “not much food in late winter” and “hope we get enough good weather to make good crops this year.” Plus peasants in the countryside can store up food against the winter, while peasants in the city generally can’t.

Industrialization creates irregular cycles of employment and unemployment, and without some kind of safety net or charity, unemployed people have trouble eating.

Peasants in the countryside can starve, but they have a hard time storming the capital. Hungry peasants in the capital are a bigger problem for government.

LikeLike

What happened in practice was that strong communities would take care of their own when they got fired, until they could find new work. People had a diverse range of jobs, and at any point most of them would be employed. The primary sources I’ve seen from imperial Russia and Britain generally talk about people going hungry because they/their breadwinner would go drink his earnings away. I’m not talking about orphans here.

Socialism always and everywhere came not from the peasants and proletariat, who are pretty conservative. It came from the educated elite, spread among the more useless middle classes (lower nobility, clerks, priests, junior officers etc.) in the universities and military (places where they had lots of time to spare) and was funded by the elite. This was the blowtorch. The proletariat and peasants were the trees, which had to be cut down, dried, split into logs, and then caught fire.

Socialism comes from above, incubates in the middle class and finally infects the lower classes, the whole time claiming to be a spontaneous movement coming from the lower classes in response to their problem. The resulting structures built by socialism involve the lower classes being much more powerless, hungry etc. than they were before, with the elites having much more power and wealth (relatively).

If you read Russian, there is a great book by a guy named Solonevich (who escaped a Soviet concentration camp on skis and crossed into Finland, then was a refugee in Nazi Germany and then Argentina) which talks about how the Russian proles and peasants uniformly hated the Communists, who were basically good-for-nothing millennials, the children of clerks who had been educated beyond their brainpower and infected with Hegelian rot.

LikeLike

Thanks for the recommendation, though alas I don’t read Russian.

I agree that socialism originated with and was spread by the elites, but it found fertile ground because industrialization dislocated people. Moving to the cities (or immigrating to America) broke up those strong families and put people into cash economies where they could spend their wages on alcohol. The structures/customs/institutions we’d built up to deal with the hardships of agriculture didn’t transfer easily to the hardships of coal mining, factories, or trench warfare. Without these changes, I doubt socialism would have become any bigger than its precursors, like Shakerism.

LikeLike

This book: https://www.amazon.com/Long-Trek-Solola-Inga-Solonevich/dp/0936015349/ref=sr_1_1?ie=UTF8&qid=1484176027&sr=8-1&keywords=Solonevich

https://www.amazon.com/Soviet-Paradise-Lost-IVAN-SOLONEVICH/dp/B0011V55PM/ref=sr_1_12?ie=UTF8&qid=1484176125&sr=8-12&keywords=Solonevich

or one of these:

https://www.amazon.com/Revolyutsiya-kotoroy-Velikaya-falshivka-fevralya/dp/5906861270/ref=sr_1_14?ie=UTF8&qid=1484176125&sr=8-14&keywords=Solonevich

https://www.amazon.com/Mify-revolyutsii-I-L-Solonevich/dp/5789302491/ref=sr_1_11?ie=UTF8&qid=1484176125&sr=8-11&keywords=Solonevich

https://www.amazon.com/Ivan-Solonevich-Narodnyi-Monarkhist-monarchist/dp/5926504422/ref=sr_1_10?ie=UTF8&qid=1484176125&sr=8-10&keywords=Solonevich

https://www.amazon.com/Solonevich-K-N-Sapozhnikov/dp/523503693X/ref=sr_1_4?ie=UTF8&qid=1484176125&sr=8-4&keywords=Solonevich ?

LikeLike

Yeah, that’s him.

LikeLike

“I agree that socialism originated with and was spread by the elites,”

So what ideas originated with and were developed by illiterate proles around the world?

Socialism covers a lot of ground.

Social security in the USA is a great socialism success story.

LikeLike

It is?

LikeLike

[…] Source: Evolutionist X […]

LikeLike

I think there’s more to this topic, and that trying to bring economics into it muddies the waters. We’ve had preposterous, inconceivable deflation over the last 30 years, which has been disguised by our fiat currency. The ramifications of this are not even considered, much less understood by anyone I’ve read.

Secondly, getting rid of free trade would go a long way towards fixing the employment situation. Efficiency brings deflation, but is murder on the job market. A little trust busting would be a good first step, and would go a long way. Unfortunately, as B mentioned earlier, the West is so thoroughly brainwashed that we are likely out of luck (unless Trump surprises).

LikeLike

“more regulation”

Then more regulation when that doesn’t work and the cycle continue. Liberals aren’t too intelligent, well at least the ones I read about and come into contact with every day.

LikeLike

Most I encounter seem smart enough; they just don’t understand that even well-meaning regulation imposes costs.

LikeLike

[…] Comments of the Week are going to BaruchK, who knows much more than I do about the rise of communism: […]

LikeLike

[…] is Part 2. Part 1 and Part 3 are […]

LikeLike

[…] is Part 1. Part 2 and Part 3 are […]

LikeLike

Doctors don’t make much money.

I have a house on a lake and a house on the beach, in a rather well heeled areas

None of my the people next to us are doctors. Or lawyers. Most of us aren’t even schooled, though one does have an ivy league degree

https://tonsplace.wordpress.com/2016/09/25/family-joke-serious-economic-thinking/

———-

Automation.

I would replace 80% of my employees with robot’s if possible. Even if robots cost slightly more

Most employees just fucking suck, especially truck drivers.

LikeLike

[…] X: Entropy, Life, and Welfare (pt. 3/3). The grand finale on her series on Social Entropy (not as allegory but as actual physical […]

LikeLike

Reblogged this on Quaerere Propter Vērum.

LikeLike